The Financial Services and Markets Act 2000 (“FSMA”) has established a general restriction on the communication of financial promotions by unauthorised persons (section 21). Now, since September 2023, the introduction of the Financial Services and Markets Act 2000 (Exemptions from Financial Promotion General Requirement) Regulations 2023 has brought some further changes.

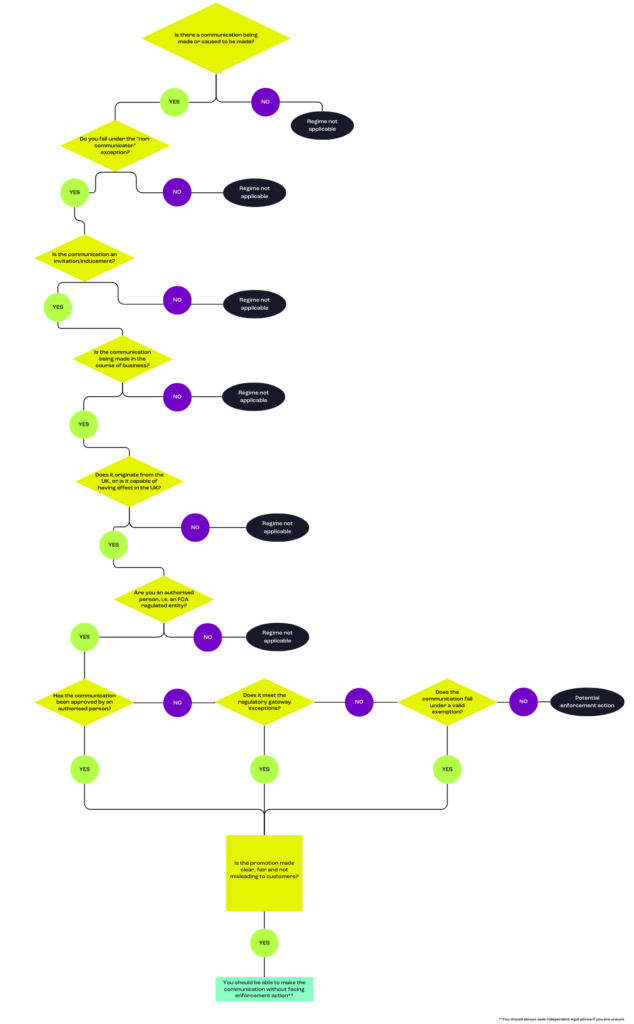

Our Financial Promotions Decision Tree is designed to help you navigate the complex regulatory framework on financial promotions and determine whether the regulations under FSMA apply to you. Please click through the Decision Tree to find out more or contact us for further advice.

What are financial promotions?

A financial promotion is any communication (e.g. an advertisement), made by a firm or company or individual (whether they are regulated or not) that invites or induces members of the public to engage in regulated financial activities, any investment activity or claims management activity in the course of business. Under the UK financial promotions regime, promotions can be real time (e.g. interactive dialogue) or non-real time (e.g. a publication), as well as solicited (e.g. occurring in response to an express request from the recipient)or unsolicited (e.g. not initiated by a request from the recipient).

When is a communication being made or caused to be made?

A person, company, or firm is communicating a financial promotion when they share their material directly with the recipient (i.e. the consumer), or where, in certain circumstances, they are only responsible for transmitting material on behalf of another person. Generally, overall responsibility for the communication lies with its originator, which is the person, firm or company responsible for the contents of the communication. Where someone other than the originator transmits a communication on behalf of the originator of the communication, they will be considered to cause the financial promotion to be communicated or cause it to be communicated, such as publishers and broadcasters who carry advertisements.

On the other hand, “non-communicators” are those people, companies or firms that are not considered to be communicating or causing the communication of a financial promotion to be made to the public and who are therefore not caught by the regulations under the regime. They consist of advertising agencies designing the materials, print producers, and those securing advertising placements without being responsible for its content.

What is an invitation or an inducement?

An invitation is a communication made to a consumer to engage in investment activity i.e., a communication of a financial promotion, that directs a person to take an action which results in their participation of such activities. Examples include direct offer advertisements, prospectuses containing application forms, and internet promotions by brokers. However simply asking a consumer if they want to enter into an agreement, without any added element of persuasion or inciting does would not constitute an invitation.

An inducement can be seen as a chain of actions with the main purpose of leading a consumer to engage in an investment activity.

What is a communication made in the course of business?

This requires a commercial interest behind the communicator, i.e. the person, firm or company, making the communication. A “commercial interest” refers to a financial or profit-related motivation behind the communication as opposed to simply giving financial advice to friends or family. Even employers communicating share schemes, for example, to their employees will be considered as a communication made “in the course of business.”

What does “fair, clear and not misleading customers” mean?

- You must ensure that products and services designed for the retail market meet the needs of specific consumer groups and are appropriately targeted to those groups.

- You are required to provide clear information to consumers and keep them adequately informed before, during, and after the point of sale.

- Consumers should receive products that perform as they have been led to expect, ,i.e. they should not be “misleading”.

- Consumers should understand clearly the implications of the products and services offered in the promotion. This should always made clear in any communications with consumers.

What are the exceptions to having the financial promotions approved by an authorised person?

This is the new regulatory gateway introduced by the changes under FSMA 2023 Regulations. There is no longer a general allowance for unauthorised persons to communicate financial promotions that have been approved by authorised persons, i.e. FCA-regulated entities. All authorised persons are subject to a requirement that prevents them from granting approvals of a financial promotion unless they are granted permission by the FCA to do so – the new “Regulatory Gateway”. However, there are exceptions to this general rule. An authorised person is exempt from this requirement to obtain permission from the FCA if:

- the authorised person that approves the communication also prepared the content of the communication;

- the unauthorised person prepared the content of the communication, and is in the same company group with the authorised person that approves the communication; and

- the content of the communication is prepared by an appointed representative, that is the unauthorised person, in relation to any regulated activity that their principal, that is the authorised person, has accepted responsibility for.

See our recent blog on these changes brought by FSMA 2023.

What is the territorial scope of the UK financial promotions regime

The regulations governing financial promotions apply to communications made in or from the UK. Any promotion with a UK connection or link, regardless of whether it is incoming or outgoing, falls under the FCA’s purview. Ultimately, a financial promotion originating outside of the UK will fall within the restriction if it is capable of having an effect in the UK, such as affecting recipients located in the UK.

What are the general exemptions under the financial promotions regime?

There are an extensive range of exemptions which fall under the financial promotions regime for unauthorised persons. These range from exemptions relating to “Controlled Activities” such as communications to investment professionals or sophisticated investors who have the requisite awareness of the activity in questions and risks involved. Other exemptions also include introductions or referrals, generic promotions that may be communicated by companies and the promotion of securities by credit institutions or exempt professional firms. There are now also limited financial promotion exemptions relating to “qualifying” cryptoassets. Please contact Founders Law if you would like more information on whether your financial promotion falls under a recognised exemption.

What enforcement action can the FCA take?

The FCA can take various enforcement actions, including issuing injunctions, conducting enforcement investigations, ordering the parties involved to take specific actions to rectify any contravention of the regulations, restraining the unauthorised person from disposing of their assets and ordering restitution.

Please note: this article is not intended as legal guidance. Please get in touch with one of our lawyers if in doubt.